(0.51%) 5 214.08 points

(0.85%) 39 388 points

(0.27%) 16 346 points

(0.62%) $79.75

(1.39%) $2.33

(0.81%) $2 359.30

(0.88%) $28.62

(0.48%) $995.60

(0.08%) $0.928

(-0.06%) $10.86

(0.06%) $0.799

(0.17%) $92.70

0.30% $ 3.34

Live Chart Being Loaded With Signals

HPI owns a Portfolio of freehold hotels and associated specialty tenancies located throughout Queensland and South Australia. The pubs are leased to the Queensland Venue Company (QVC), a joint venture between Coles group and Australian Venue Company, and to Australian Leisure & Hospitality ("ALH"), a joint venture 75% owned by the Woolworths group...

| Stats | |

|---|---|

| Dzisiejszy wolumen | 73 968.00 |

| Średni wolumen | 684 031 |

| Kapitalizacja rynkowa | 650.97M |

| EPS | $0 ( 2024-02-14 ) |

| Last Dividend | $0.0940 ( 2023-06-29 ) |

| Next Dividend | $0 ( N/A ) |

| P/E | 30.36 |

| ATR14 | $0.00700 (0.21%) |

Wolumen Korelacja

Hotel Property Korelacja

| 10 Najbardziej pozytywne korelacje |

|---|

| 10 Najbardziej negatywne korelacje |

|---|

Did You Know?

Correlation is a statistical measure that describes the relationship between two variables. It ranges from -1 to 1, where -1 indicates a perfect negative correlation (as one variable increases, the other decreases), 1 indicates a perfect positive correlation (as one variable increases, the other increases), and 0 indicates no correlation (there is no relationship between the variables).

Correlation can be used to analyze the relationship between any two variables, not just stocks. It's commonly used in fields such as finance, economics, psychology, and more.

Hotel Property Korelacja - Waluta/Towar

Hotel Property Finanse

| Annual | 2023 |

| Przychody: | $79.84M |

| Zysk brutto: | $67.24M (84.22 %) |

| EPS: | $0.0185 |

| FY | 2023 |

| Przychody: | $79.84M |

| Zysk brutto: | $67.24M (84.22 %) |

| EPS: | $0.0185 |

| FY | 2022 |

| Przychody: | $73.97M |

| Zysk brutto: | $62.75M (84.82 %) |

| EPS: | $1.120 |

| FY | 2021 |

| Przychody: | $60.14M |

| Zysk brutto: | $50.66M (84.24 %) |

| EPS: | $0.581 |

Financial Reports:

No articles found.

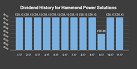

Hotel Property Dividends

| (Q3/22) | (Q4/22) | (Q1/23) | (Q2/23) | (Q3/23) | (Q4/23) | (Q1/24) | (Q2/24) | (Q3/24) | (Q4/24) |

| $0 (N/A) |

$0.0920 (N/A) |

$0 (N/A) |

$0.0940 (N/A) |

$0 (N/A) |

$0 (N/A) |

$0 (N/A) |

$0 (N/A) |

$0 (N/A) |

$0 (N/A) |

Very Unsafe

High risk of being cut

Unsafe

Heightened risk of being cut

Borderline

Moderate risk of being cut

Safe

Unlikely to be cut

Very Safe

Very unlikely to be cut

| First Dividend | $0.0880 | 2014-06-26 |

| Last Dividend | $0.0940 | 2023-06-29 |

| Next Dividend | $0 | N/A |

| Payout Date | 0000-00-00 | |

| Next Payout Date | N/A | |

| # dividends | 19 | -- |

| Total Paid Out | $1.934 | -- |

| Avg. Dividend % Per Year | 0.00% | -- |

| Score | 2.82 | -- |

| Div. Sustainability Score | 6.12 | |

| Div.Growth Potential Score | 4.71 | |

| Div. Directional Score | 5.42 | -- |

| Year | Amount | Yield |

|---|

With a moderate Dividend Sustainability Score (DSS), the company may sustain its dividends, but continuous monitoring is advised for any financial shifts. Unfortunately, its low Dividend Growth Potential Score (DGPS) suggests limited prospects for dividend growth. On the whole, the dividend outlook remains neutral, meriting close observation of both the company's financial health and growth prospects.

| Symbol | Title | Last dividend | Frequency | Years Dividend | Yearly Dividend | Score |

|---|---|---|---|---|---|---|

| QBE.AX | Ex Dividend Knight | 2023-08-17 | Annually | 0 | 0.00% | |

| AZJ.AX | Ex Dividend Junior | 2023-08-28 | Semi-Annually | 0 | 0.00% | |

| IPH.AX | Ex Dividend Knight | 2023-08-22 | Semi-Annually | 0 | 0.00% | |

| SIG.AX | Ex Dividend Knight | 2023-09-25 | Annually | 0 | 0.00% | |

| CGF.AX | Ex Dividend Junior | 2023-08-28 | Annually | 0 | 0.00% | |

| MIR.AX | Ex Dividend Knight | 2023-07-28 | Semi-Annually | 0 | 0.00% | |

| URF.AX | No Dividend Player | 2023-06-29 | Annually | 0 | 0.00% | |

| DDR.AX | Ex Dividend Knight | 2023-08-16 | Quarterly | 0 | 0.00% | |

| OCL.AX | Ex Dividend Knight | 2023-09-08 | Annually | 0 | 0.00% | |

| ACQ.AX | Ex Dividend Knight | 2023-11-09 | Semi-Annually | 0 | 0.00% |

| Ratio | Actual Value | Weight | Normalized Value | Score | Range |

|---|---|---|---|---|---|

| netProfitMarginTTM | 0.259 | 1.500 | 4.82 | 7.23 | [0 - 0.5] |

| returnOnAssetsTTM | 0.0164 | 1.200 | 9.45 | 10.00 | [0 - 0.3] |

| returnOnEquityTTM | 0.0270 | 1.500 | -0.811 | -1.217 | [0.1 - 1] |

| payoutRatioTTM | 0.742 | -1.000 | 2.58 | -2.58 | [0 - 1] |

| currentRatioTTM | 0.214 | 0.800 | -3.93 | -3.14 | [1 - 3] |

| quickRatioTTM | 0.0814 | 0.800 | -4.23 | -3.38 | [0.8 - 2.5] |

| cashRatioTTM | 0.0606 | 1.500 | -0.774 | -1.162 | [0.2 - 2] |

| debtRatioTTM | 0.366 | -1.500 | 3.89 | -5.84 | [0 - 0.6] |

| interestCoverageTTM | 2.36 | 1.000 | -0.238 | -0.238 | [3 - 30] |

| operatingCashFlowPerShareTTM | 0.338 | 2.00 | 9.89 | 10.00 | [0 - 30] |

| freeCashFlowPerShareTTM | 0.338 | 2.00 | 9.83 | 10.00 | [0 - 20] |

| debtEquityRatioTTM | 0.605 | -1.500 | 7.58 | -10.00 | [0 - 2.5] |

| grossProfitMarginTTM | 0.841 | 1.000 | 10.00 | 10.00 | [0.2 - 0.8] |

| operatingProfitMarginTTM | 0.782 | 1.000 | 10.00 | 10.00 | [0.1 - 0.6] |

| cashFlowToDebtRatioTTM | 0.141 | 1.000 | -0.330 | -0.330 | [0.2 - 2] |

| assetTurnoverTTM | 0.0634 | 0.800 | -2.91 | -2.33 | [0.5 - 2] |

| Total Score | 6.12 | ||||

| Ratio | Actual Value | Weight | Normalized Value | Score | Range |

|---|---|---|---|---|---|

| peRatioTTM | 31.06 | 1.000 | 6.96 | 0 | [1 - 100] |

| returnOnEquityTTM | 0.0270 | 2.50 | -0.521 | -1.217 | [0.1 - 1.5] |

| freeCashFlowPerShareTTM | 0.338 | 2.00 | 9.89 | 10.00 | [0 - 30] |

| dividendYielPercentageTTM | 5.63 | 1.500 | 10.00 | 0 | [0 - 0.4] |

| operatingCashFlowPerShareTTM | 0.338 | 2.00 | 9.89 | 10.00 | [0 - 30] |

| payoutRatioTTM | 0.742 | 1.500 | 2.58 | -2.58 | [0 - 1] |

| pegRatioTTM | 0.260 | 1.500 | -1.602 | 0 | [0.5 - 2] |

| operatingCashFlowSalesRatioTTM | 0.811 | 1.000 | 10.00 | 0 | [0.1 - 0.5] |

| Total Score | 4.71 | ||||

Hotel Property

HPI owns a Portfolio of freehold hotels and associated specialty tenancies located throughout Queensland and South Australia. The pubs are leased to the Queensland Venue Company (QVC), a joint venture between Coles group and Australian Venue Company, and to Australian Leisure & Hospitality ("ALH"), a joint venture 75% owned by the Woolworths group. HPI's objective is to maximise the long term income and capital returns from its investments for the benefit of its Securityholders. Approximately 93% of the income is earned from the pubs leased to QVC and ALH. The remaining rental income is derived from Speciality Tenants leasing the On-site Specialty Stores. Specialty Tenants include a mix of franchisors and franchisees including 7-Eleven, Nightowl, Nando's, Subway, Noodle Box, The Good Guys and Quest Apartments. The Responsible Entity of the Trust is Hotel Property Investments Limited.

O Sygnały na żywo

Prezentowane na tej stronie sygnały na żywo pomagają określić, kiedy KUPIĆ lub SPRZEDAĆ BRAK DANYCH. Sygnały mogą mieć opóźnienie wynoszące nawet 1 minutę; jak wszystkie sygnały rynkowe, istnieje ryzyko błędu lub pomyłki.

Sygnały transakcyjne na żywo nie są ostateczne i getagraph.com nie ponosi odpowiedzialności za żadne działania podjęte na podstawie tych sygnałów, jak opisano w Warunkach Użytkowania. Sygnały opierają się na szerokim zakresie wskaźników analizy technicznej