Unlock the power of data-driven investing with our easy-to-use tool for analyzing the correlation between stocks. With just a few clicks, you can gain valuable insights into the relationship between any two stocks in your portfolio or the wider market. Whether you're a seasoned investor or just starting out, our tool provides the clarity and confidence you need to make informed investment decisions. Try it out today and start discovering the correlation between stocks like never before!

Hit the correlation button and we will give you some textual insights.

Did You Know?

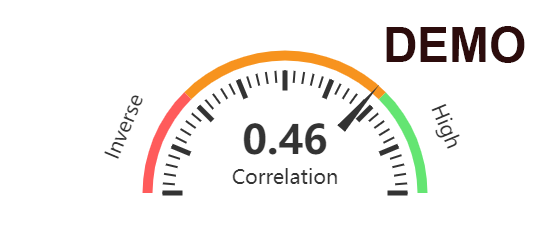

Correlation is a statistical measure that describes the relationship between two variables. It ranges from -1 to 1, where -1 indicates a perfect negative correlation (as one variable increases, the other decreases), 1 indicates a perfect positive correlation (as one variable increases, the other increases), and 0 indicates no correlation (there is no relationship between the variables).

Correlation can be used to analyze the relationship between any two variables, not just stocks. It's commonly used in fields such as finance, economics, psychology, and more.

About Correlation

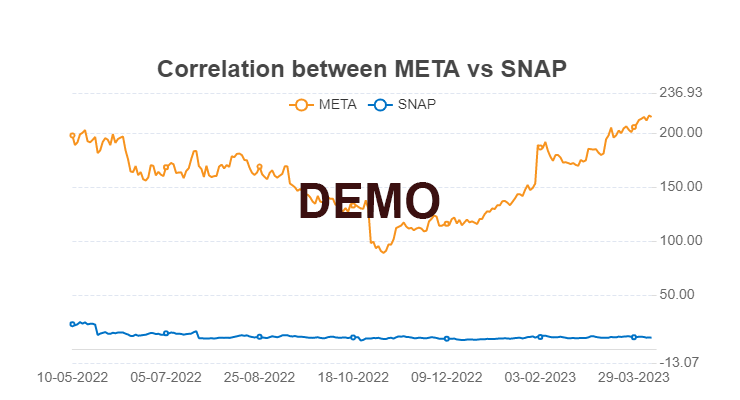

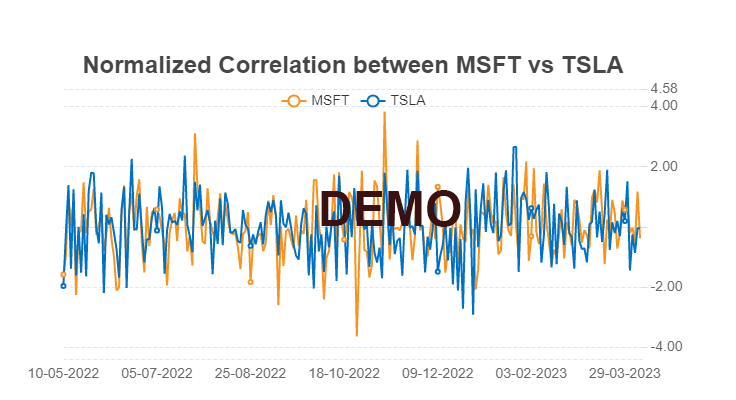

Our stock correlation tool is designed to analyze the historical price data of various stocks and calculate their correlation coefficient. This coefficient measures the degree to which two stocks move in relation to each other.

By understanding the correlation between two stocks, traders can determine if they have a positive correlation (move in the same direction) or a negative correlation (move in opposite directions). This information can be used to identify pairs of stocks that are highly correlated, allowing traders to diversify their portfolio by investing in stocks from different industries or sectors.

In addition, traders can use the correlation coefficient to hedge against market volatility by identifying stocks that have a negative correlation with their existing holdings. This way, if one stock in their portfolio experiences a sudden price drop, the other stock will likely rise, minimizing losses.

Overall, our stock correlation tool provides valuable insights for traders looking to optimize their portfolio and make informed trading decisions. By understanding the correlation between different stocks, traders can make informed decisions about which stocks to buy, sell, or hold in their portfolio.

AMEX

AMEX Toronto

Toronto Mexico

Mexico Santiago

Santiago Amsterdam (EuroNext)

Amsterdam (EuroNext) Dublin

Dublin Frankfurt

Frankfurt Helsinki

Helsinki IOB

IOB Moscow

Moscow Oslo

Oslo Warsaw

Warsaw Stockholm

Stockholm Vienna

Vienna Zurich

Zurich Athens

Athens Milan

Milan Sydney

Sydney Jakarta

Jakarta Dubai Financial Markets

Dubai Financial Markets HongKong

HongKong Istanbul

Istanbul Tokyo

Tokyo NSE

NSE Saudi Exchange

Saudi Exchange Shanghai

Shanghai South Korea

South Korea Stock Exchange of Thailand

Stock Exchange of Thailand Taiwan

Taiwan Tel Aviv

Tel Aviv Quatar

Quatar Johannesburg

Johannesburg