(1.02%) 5 099.96 points

(0.40%) 38 240 points

(2.03%) 15 928 points

(0.11%) $83.66

(-1.16%) $1.619

(0.30%) $2 349.60

(-0.43%) $27.52

(0.42%) $924.40

(0.32%) $0.935

(0.67%) $11.02

(0.13%) $0.800

(-0.07%) $92.11

Live Chart Being Loaded With Signals

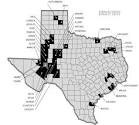

Permian Basin Royalty Trust, an express trust, holds overriding royalty interests in various oil and gas properties in the United States. The company owns a 75% net overriding royalty interest in the Waddell Ranch properties comprising Dune, Sand Hills (Judkins), Sand Hills (McKnight), Sand Hills (Tubb), University-Waddell (Devonian), and Waddell fields located in Crane County, Texas...

| Stats | |

|---|---|

| Dagens volum | 69 688.00 |

| Gjennomsnittsvolum | 147 765 |

| Markedsverdi | 568.63M |

| EPS | $0 ( 2024-03-06 ) |

| Neste inntjeningsdato | ( $0 ) 2024-05-06 |

| Last Dividend | $0.157 ( 2023-11-29 ) |

| Next Dividend | $0 ( N/A ) |

| P/E | 20.33 |

| ATR14 | $0.0220 (0.18%) |

| Date | Person | Action | Amount | type |

|---|---|---|---|---|

| 2005-09-09 | Burlington Resources Oil & Gas Co Lp | Sell | 100 000 | Units of Beneficial Interest |

| 2005-12-21 | Burlington Resources Oil & Gas Co Lp | Sell | 8 600 000 | Units of Beneficial Interest |

| 2006-01-19 | Burlington Resources Oil & Gas Co Lp | Sell | 1 007 000 | Units of Beneficial Interest |

| 2005-08-02 | Burlington Resources Oil & Gas Co Lp | Sell | 8 250 000 | Units of Beneficial Interest |

| INSIDER POWER |

|---|

| 0.00 |

| Last 4 transactions |

| Buy: 0 | Sell: 17 957 000 |

Volum Korrelasjon

Permian Basin Royalty Korrelasjon

| 10 Mest positive korrelasjoner |

|---|

| 10 Mest negative korrelasjoner |

|---|

Visste du det?

Korrelasjon er en statistisk måling som beskriver forholdet mellom to variabler. Den varierer fra -1 til 1, hvor -1 indikerer en perfekt negativ korrelasjon (hvor en variabel øker, går den andre ned), 1 indikerer en perfekt positiv korrelasjon (hvor en variabel øker, går den andre også opp), og 0 indikerer ingen korrelasjon (det er ingen forhold mellom variablene).

Korrelasjon kan brukes til å analysere forholdet mellom to variabler, ikke bare aksjer. Det er vanligvis brukt innen områder som finans, økonomi, psykologi, og mer.

Permian Basin Royalty Korrelasjon - Valuta/Råvare

Permian Basin Royalty Økonomi

| Annual | 2023 |

| Omsetning: | $29.10M |

| Bruttogevinst: | $29 010.70B (99 704 800.00 %) |

| EPS: | $0.600 |

| FY | 2023 |

| Omsetning: | $29.10M |

| Bruttogevinst: | $29 010.70B (99 704 800.00 %) |

| EPS: | $0.600 |

| FY | 2022 |

| Omsetning: | $54.47M |

| Bruttogevinst: | $54.47M (100.00 %) |

| EPS: | $1.150 |

| FY | 2021 |

| Omsetning: | $0.00 |

| Bruttogevinst: | $0.00 (0.00 %) |

| EPS: | $0.230 |

Financial Reports:

No articles found.

Permian Basin Royalty Dividends

| (Q3/22) | (Q4/22) | (Q1/23) | (Q2/23) | (Q3/23) | (Q4/23) | (Q1/24) | (Q2/24) | (Q3/24) | (Q4/24) |

| $0.584 (N/A) |

$0.327 (N/A) |

$0.102 (N/A) |

$0.124 (N/A) |

$0.0687 (N/A) |

$0.200 (N/A) |

$0 (N/A) |

$0 (N/A) |

$0 (N/A) |

$0 (N/A) |

Very Unsafe

High risk of being cut

Unsafe

Heightened risk of being cut

Borderline

Moderate risk of being cut

Safe

Unlikely to be cut

Very Safe

Very unlikely to be cut

| First Dividend | $0.0317 | 1986-12-24 |

| Last Dividend | $0.157 | 2023-11-29 |

| Next Dividend | $0 | N/A |

| Payout Date | 2023-12-14 | |

| Next Payout Date | N/A | |

| # dividends | 443 | -- |

| Total Paid Out | $28.43 | -- |

| Avg. Dividend % Per Year | 4.12% | -- |

| Score | 6.31 | -- |

| Div. Sustainability Score | 7.49 | |

| Div.Growth Potential Score | 3.55 | |

| Div. Directional Score | 5.52 | -- |

| Year | Amount | Yield |

|---|---|---|

| 1986 | $0.0317 | 0.45% |

| 1987 | $1.085 | 17.40% |

| 1988 | $1.029 | 16.80% |

| 1989 | $0.464 | 7.28% |

| 1990 | $0.532 | 8.67% |

| 1991 | $0.505 | 11.20% |

| 1992 | $0.466 | 11.00% |

| 1993 | $0.418 | 10.50% |

| 1994 | $0.322 | 6.60% |

| 1995 | $0.420 | 9.87% |

| 1996 | $0.405 | 12.90% |

| 1997 | $0.473 | 10.80% |

| 1998 | $0.384 | 8.90% |

| 1999 | $0.455 | 11.40% |

| 2000 | $0.762 | 13.90% |

| 2001 | $0.847 | 14.10% |

| 2002 | $0.502 | 9.29% |

| 2003 | $0.689 | 10.90% |

| 2004 | $0.957 | 11.60% |

| 2005 | $1.336 | 9.79% |

| 2006 | $1.410 | 8.99% |

| 2007 | $1.452 | 9.06% |

| 2008 | $2.39 | 14.80% |

| 2009 | $0.809 | 5.61% |

| 2010 | $1.376 | 9.30% |

| 2011 | $1.360 | 5.95% |

| 2012 | $1.083 | 5.34% |

| 2013 | $0.870 | 6.95% |

| 2014 | $1.024 | 7.91% |

| 2015 | $0.345 | 3.67% |

| 2016 | $0.415 | 7.74% |

| 2017 | $0.630 | 7.84% |

| 2018 | $0.660 | 7.45% |

| 2019 | $0.418 | 6.74% |

| 2020 | $0.235 | 6.01% |

| 2021 | $0.230 | 6.73% |

| 2022 | $1.149 | 11.20% |

| 2023 | $0.495 | 2.20% |

| 2024 | $0 | 0.00% |

The company's strong Dividend Sustainability Score (DSS) indicates its robust capacity to uphold current dividend levels. Unfortunately, its low Dividend Growth Potential Score (DGPS) suggests limited prospects for dividend growth. On the whole, the dividend outlook remains neutral, meriting close observation of both the company's financial health and growth prospects.

| Symbol | Title | Last dividend | Frequency | Years Dividend | Yearly Dividend | Score |

|---|---|---|---|---|---|---|

| LOMA | Dividend Knight | 2023-06-30 | Quarterly | 2 | 5.23% | 8.53 |

| PVL | Dividend King | 2023-11-15 | Monthly | 14 | 9.37% | 8.50 |

| NCV | Dividend Royal | 2024-02-09 | Monthly | 22 | 7.68% | 8.50 |

| SBR | Dividend Royal | 2023-11-14 | Monthly | 38 | 7.74% | 8.50 |

| MTR | Dividend Diamond | 2023-10-30 | Monthly | 39 | 10.10% | 8.50 |

| PDI | Dividend Royal | 2023-11-10 | Monthly | 13 | 7.86% | 8.50 |

| ZTR | Dividend King | 2024-02-09 | Monthly | 37 | 8.35% | 8.50 |

| ORC | Dividend Royal | 2023-11-29 | Monthly | 12 | 9.23% | 8.50 |

| JQC | Dividend Royal | 2023-11-14 | Monthly | 22 | 6.56% | 8.50 |

| NCZ | Dividend Royal | 2024-02-09 | Monthly | 22 | 7.79% | 8.50 |

| Ratio | Actual Value | Weight | Normalized Value | Score | Range |

|---|---|---|---|---|---|

| netProfitMarginTTM | 0.962 | 1.500 | 10.00 | 10.00 | [0 - 0.5] |

| returnOnAssetsTTM | 4.46 | 1.200 | 10.00 | 10.00 | [0 - 0.3] |

| returnOnEquityTTM | 136.52 | 1.500 | 10.00 | 10.00 | [0.1 - 1] |

| payoutRatioTTM | 0 | -1.000 | 0 | 0 | [0 - 1] |

| currentRatioTTM | 1.222 | 0.800 | 8.89 | 7.11 | [1 - 3] |

| quickRatioTTM | 1.222 | 0.800 | 7.52 | 6.01 | [0.8 - 2.5] |

| cashRatioTTM | 1 222.16 | 1.500 | 10.00 | 10.00 | [0.2 - 2] |

| debtRatioTTM | 0 | -1.500 | 0 | 0 | [0 - 0.6] |

| interestCoverageTTM | 0 | 1.000 | -1.111 | -1.111 | [3 - 30] |

| operatingCashFlowPerShareTTM | 0 | 2.00 | 0 | 0 | [0 - 30] |

| freeCashFlowPerShareTTM | 0 | 2.00 | 0 | 0 | [0 - 20] |

| debtEquityRatioTTM | 0 | -1.500 | 0 | 0 | [0 - 2.5] |

| grossProfitMarginTTM | 1.000 | 1.000 | 10.00 | 10.00 | [0.2 - 0.8] |

| operatingProfitMarginTTM | 1.057 | 1.000 | 10.00 | 10.00 | [0.1 - 0.6] |

| cashFlowToDebtRatioTTM | 0 | 1.000 | -1.111 | -1.111 | [0.2 - 2] |

| assetTurnoverTTM | 4.64 | 0.800 | 10.00 | 8.00 | [0.5 - 2] |

| Total Score | 7.49 | ||||

| Ratio | Actual Value | Weight | Normalized Value | Score | Range |

|---|---|---|---|---|---|

| peRatioTTM | 20.32 | 1.000 | 8.05 | 0 | [1 - 100] |

| returnOnEquityTTM | 136.52 | 2.50 | 10.00 | 10.00 | [0.1 - 1.5] |

| freeCashFlowPerShareTTM | 0 | 2.00 | 0 | 0 | [0 - 30] |

| dividendYielPercentageTTM | 4.83 | 1.500 | 10.00 | 0 | [0 - 0.4] |

| operatingCashFlowPerShareTTM | 0 | 2.00 | 0 | 0 | [0 - 30] |

| payoutRatioTTM | 0 | 1.500 | 0 | 0 | [0 - 1] |

| pegRatioTTM | 0.864 | 1.500 | 7.57 | 0 | [0.5 - 2] |

| operatingCashFlowSalesRatioTTM | 0 | 1.000 | -2.50 | 0 | [0.1 - 0.5] |

| Total Score | 3.55 | ||||

Permian Basin Royalty

Permian Basin Royalty Trust, an express trust, holds overriding royalty interests in various oil and gas properties in the United States. The company owns a 75% net overriding royalty interest in the Waddell Ranch properties comprising Dune, Sand Hills (Judkins), Sand Hills (McKnight), Sand Hills (Tubb), University-Waddell (Devonian), and Waddell fields located in Crane County, Texas. It also holds a 95% net overriding royalty in the Texas Royalty properties, which consist of various producing oil fields, such as Yates, Wasson, Sand Hills, East Texas, Kelly-Snyder, Panhandle Regular, N. Cowden, Todd, Keystone, Kermit, McElroy, Howard-Glasscock, Seminole, and others located in 33 counties in Texas. Its Texas Royalty properties comprise approximately 125 separate royalty interests containing approximately 51,000 net producing acres. The company was founded in 1980 and is based in Dallas, Texas.

Om Live Signaler

Live Trading signaler pa denne siden er ment til å hjelpe deg i beslutningsprossessen for når du bør KJØPE eller SELGE NA. Signalene har opp mot 1-minutt forsinkelse; som med alle andre indikatorer og signaler, er det en viss sjanse for feil eller feilkalkuleringer.

Live signalene er kun veiledende, og getagraph.com tar ikke noen form for ansvar basert pa handlinger gjort på disse signalene som beskrevet i Terms of Use. Signalene er basert på en rekke indikatorer og påliteligheten vil variere sterke fra aksje til aksje.