(1.02%) 5 099.96 points

(0.40%) 38 240 points

(2.03%) 15 928 points

(0.11%) $83.66

(-1.16%) $1.619

(0.30%) $2 349.60

(-0.43%) $27.52

(0.42%) $924.40

(0.32%) $0.935

(0.67%) $11.02

(0.13%) $0.800

(-0.07%) $92.11

1.58% $ 12.20

Live Chart Being Loaded With Signals

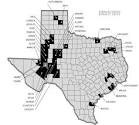

Permian Basin Royalty Trust, an express trust, holds overriding royalty interests in various oil and gas properties in the United States. The company owns a 75% net overriding royalty interest in the Waddell Ranch properties comprising Dune, Sand Hills (Judkins), Sand Hills (McKnight), Sand Hills (Tubb), University-Waddell (Devonian), and Waddell fields located in Crane County, Texas...

| Stats | |

|---|---|

| Объем за сегодня | 69 688.00 |

| Средний объем | 147 765 |

| Рыночная капитализация | 568.63M |

| EPS | $0 ( 2024-03-06 ) |

| Дата следующего отчета о доходах | ( $0 ) 2024-05-06 |

| Last Dividend | $0.157 ( 2023-11-29 ) |

| Next Dividend | $0 ( N/A ) |

| P/E | 20.33 |

| ATR14 | $0.0220 (0.18%) |

| Date | Person | Action | Amount | type |

|---|---|---|---|---|

| 2005-09-09 | Burlington Resources Oil & Gas Co Lp | Sell | 100 000 | Units of Beneficial Interest |

| 2005-12-21 | Burlington Resources Oil & Gas Co Lp | Sell | 8 600 000 | Units of Beneficial Interest |

| 2006-01-19 | Burlington Resources Oil & Gas Co Lp | Sell | 1 007 000 | Units of Beneficial Interest |

| 2005-08-02 | Burlington Resources Oil & Gas Co Lp | Sell | 8 250 000 | Units of Beneficial Interest |

| INSIDER POWER |

|---|

| 0.00 |

| Last 4 transactions |

| Buy: 0 | Sell: 17 957 000 |

Объем Корреляция

Permian Basin Royalty Корреляция

| 10 Самые положительные корреляции |

|---|

| 10 Самые отрицательные корреляции |

|---|

Вы знали?

Корреляция - это статистический показатель, описывающий связь между двумя переменными. Он изменяется от -1 до 1, где -1 указывает на идеальную отрицательную корреляцию (при увеличении одной переменной другая уменьшается), 1 указывает на идеальную положительную корреляцию (при увеличении одной переменной другая увеличивается), а 0 указывает на отсутствие корреляции (между переменными нет связи).

Корреляцию можно использовать для анализа связи между любыми двумя переменными, не только акциями. Она широко используется в таких областях, как финансы, экономика, психология и т. д.

Permian Basin Royalty Корреляция - Валюта/Сырье

Permian Basin Royalty Финансовые показатели

| Annual | 2023 |

| Выручка: | $29.10M |

| Валовая прибыль: | $29 010.70B (99 704 800.00 %) |

| EPS: | $0.600 |

| FY | 2023 |

| Выручка: | $29.10M |

| Валовая прибыль: | $29 010.70B (99 704 800.00 %) |

| EPS: | $0.600 |

| FY | 2022 |

| Выручка: | $54.47M |

| Валовая прибыль: | $54.47M (100.00 %) |

| EPS: | $1.150 |

| FY | 2021 |

| Выручка: | $0.00 |

| Валовая прибыль: | $0.00 (0.00 %) |

| EPS: | $0.230 |

Financial Reports:

No articles found.

Permian Basin Royalty Dividends

| (Q3/22) | (Q4/22) | (Q1/23) | (Q2/23) | (Q3/23) | (Q4/23) | (Q1/24) | (Q2/24) | (Q3/24) | (Q4/24) |

| $0.584 (N/A) |

$0.327 (N/A) |

$0.102 (N/A) |

$0.124 (N/A) |

$0.0687 (N/A) |

$0.200 (N/A) |

$0 (N/A) |

$0 (N/A) |

$0 (N/A) |

$0 (N/A) |

Very Unsafe

High risk of being cut

Unsafe

Heightened risk of being cut

Borderline

Moderate risk of being cut

Safe

Unlikely to be cut

Very Safe

Very unlikely to be cut

| First Dividend | $0.0317 | 1986-12-24 |

| Last Dividend | $0.157 | 2023-11-29 |

| Next Dividend | $0 | N/A |

| Payout Date | 2023-12-14 | |

| Next Payout Date | N/A | |

| # dividends | 443 | -- |

| Total Paid Out | $28.43 | -- |

| Avg. Dividend % Per Year | 4.12% | -- |

| Score | 6.31 | -- |

| Div. Sustainability Score | 7.49 | |

| Div.Growth Potential Score | 3.55 | |

| Div. Directional Score | 5.52 | -- |

| Year | Amount | Yield |

|---|---|---|

| 1986 | $0.0317 | 0.45% |

| 1987 | $1.085 | 17.40% |

| 1988 | $1.029 | 16.80% |

| 1989 | $0.464 | 7.28% |

| 1990 | $0.532 | 8.67% |

| 1991 | $0.505 | 11.20% |

| 1992 | $0.466 | 11.00% |

| 1993 | $0.418 | 10.50% |

| 1994 | $0.322 | 6.60% |

| 1995 | $0.420 | 9.87% |

| 1996 | $0.405 | 12.90% |

| 1997 | $0.473 | 10.80% |

| 1998 | $0.384 | 8.90% |

| 1999 | $0.455 | 11.40% |

| 2000 | $0.762 | 13.90% |

| 2001 | $0.847 | 14.10% |

| 2002 | $0.502 | 9.29% |

| 2003 | $0.689 | 10.90% |

| 2004 | $0.957 | 11.60% |

| 2005 | $1.336 | 9.79% |

| 2006 | $1.410 | 8.99% |

| 2007 | $1.452 | 9.06% |

| 2008 | $2.39 | 14.80% |

| 2009 | $0.809 | 5.61% |

| 2010 | $1.376 | 9.30% |

| 2011 | $1.360 | 5.95% |

| 2012 | $1.083 | 5.34% |

| 2013 | $0.870 | 6.95% |

| 2014 | $1.024 | 7.91% |

| 2015 | $0.345 | 3.67% |

| 2016 | $0.415 | 7.74% |

| 2017 | $0.630 | 7.84% |

| 2018 | $0.660 | 7.45% |

| 2019 | $0.418 | 6.74% |

| 2020 | $0.235 | 6.01% |

| 2021 | $0.230 | 6.73% |

| 2022 | $1.149 | 11.20% |

| 2023 | $0.495 | 2.20% |

| 2024 | $0 | 0.00% |

The company's strong Dividend Sustainability Score (DSS) indicates its robust capacity to uphold current dividend levels. Unfortunately, its low Dividend Growth Potential Score (DGPS) suggests limited prospects for dividend growth. On the whole, the dividend outlook remains neutral, meriting close observation of both the company's financial health and growth prospects.

| Symbol | Title | Last dividend | Frequency | Years Dividend | Yearly Dividend | Score |

|---|---|---|---|---|---|---|

| LOMA | Dividend Knight | 2023-06-30 | Quarterly | 2 | 5.23% | 8.53 |

| VGI | Dividend Royal | 2024-02-09 | Monthly | 13 | 7.36% | 8.50 |

| PHK | Dividend Royal | 2023-11-10 | Monthly | 22 | 6.88% | 8.50 |

| JQC | Dividend Royal | 2023-11-14 | Monthly | 22 | 6.56% | 8.50 |

| PCF | Dividend King | 2023-12-18 | Monthly | 38 | 7.05% | 8.50 |

| PVL | Dividend King | 2023-11-15 | Monthly | 14 | 9.37% | 8.50 |

| NCV | Dividend Royal | 2024-02-09 | Monthly | 22 | 7.68% | 8.50 |

| SBR | Dividend Royal | 2023-11-14 | Monthly | 38 | 7.74% | 8.50 |

| MTR | Dividend Diamond | 2023-10-30 | Monthly | 39 | 10.10% | 8.50 |

| PDI | Dividend Royal | 2023-11-10 | Monthly | 13 | 7.86% | 8.50 |

| Ratio | Actual Value | Weight | Normalized Value | Score | Range |

|---|---|---|---|---|---|

| netProfitMarginTTM | 0.962 | 1.500 | 10.00 | 10.00 | [0 - 0.5] |

| returnOnAssetsTTM | 4.46 | 1.200 | 10.00 | 10.00 | [0 - 0.3] |

| returnOnEquityTTM | 136.52 | 1.500 | 10.00 | 10.00 | [0.1 - 1] |

| payoutRatioTTM | 0 | -1.000 | 0 | 0 | [0 - 1] |

| currentRatioTTM | 1.222 | 0.800 | 8.89 | 7.11 | [1 - 3] |

| quickRatioTTM | 1.222 | 0.800 | 7.52 | 6.01 | [0.8 - 2.5] |

| cashRatioTTM | 1 222.16 | 1.500 | 10.00 | 10.00 | [0.2 - 2] |

| debtRatioTTM | 0 | -1.500 | 0 | 0 | [0 - 0.6] |

| interestCoverageTTM | 0 | 1.000 | -1.111 | -1.111 | [3 - 30] |

| operatingCashFlowPerShareTTM | 0 | 2.00 | 0 | 0 | [0 - 30] |

| freeCashFlowPerShareTTM | 0 | 2.00 | 0 | 0 | [0 - 20] |

| debtEquityRatioTTM | 0 | -1.500 | 0 | 0 | [0 - 2.5] |

| grossProfitMarginTTM | 1.000 | 1.000 | 10.00 | 10.00 | [0.2 - 0.8] |

| operatingProfitMarginTTM | 1.057 | 1.000 | 10.00 | 10.00 | [0.1 - 0.6] |

| cashFlowToDebtRatioTTM | 0 | 1.000 | -1.111 | -1.111 | [0.2 - 2] |

| assetTurnoverTTM | 4.64 | 0.800 | 10.00 | 8.00 | [0.5 - 2] |

| Total Score | 7.49 | ||||

| Ratio | Actual Value | Weight | Normalized Value | Score | Range |

|---|---|---|---|---|---|

| peRatioTTM | 20.32 | 1.000 | 8.05 | 0 | [1 - 100] |

| returnOnEquityTTM | 136.52 | 2.50 | 10.00 | 10.00 | [0.1 - 1.5] |

| freeCashFlowPerShareTTM | 0 | 2.00 | 0 | 0 | [0 - 30] |

| dividendYielPercentageTTM | 4.83 | 1.500 | 10.00 | 0 | [0 - 0.4] |

| operatingCashFlowPerShareTTM | 0 | 2.00 | 0 | 0 | [0 - 30] |

| payoutRatioTTM | 0 | 1.500 | 0 | 0 | [0 - 1] |

| pegRatioTTM | 0.864 | 1.500 | 7.57 | 0 | [0.5 - 2] |

| operatingCashFlowSalesRatioTTM | 0 | 1.000 | -2.50 | 0 | [0.1 - 0.5] |

| Total Score | 3.55 | ||||

Permian Basin Royalty

Permian Basin Royalty Trust, an express trust, holds overriding royalty interests in various oil and gas properties in the United States. The company owns a 75% net overriding royalty interest in the Waddell Ranch properties comprising Dune, Sand Hills (Judkins), Sand Hills (McKnight), Sand Hills (Tubb), University-Waddell (Devonian), and Waddell fields located in Crane County, Texas. It also holds a 95% net overriding royalty in the Texas Royalty properties, which consist of various producing oil fields, such as Yates, Wasson, Sand Hills, East Texas, Kelly-Snyder, Panhandle Regular, N. Cowden, Todd, Keystone, Kermit, McElroy, Howard-Glasscock, Seminole, and others located in 33 counties in Texas. Its Texas Royalty properties comprise approximately 125 separate royalty interests containing approximately 51,000 net producing acres. The company was founded in 1980 and is based in Dallas, Texas.

О Торговые сигналы

Данные торговые сигналы, представленные на этой странице, помогают определить, когда следует ПОКУПАТЬ или ПРОДАВАТЬ NA. Сигналы имеют задержку более 1 минуты. Пожалуйста, примите во внимание, что существует вероятность ошибки или неточностей в силу различных микро и макро факторов влияющих на фондовые рынки.

Данные тор“о”ые сигна“ы не являются определен“ыми, и getagraph.com не несет ответственности за какие-либо действия, предпринятые в от“ошении этих сигналов, как описано в Terms of Use. Сигналы основаны на широком спектре индикаторов технического анализа